Simulation analysis of the effect and stability for Korea National Pension

- Summary

- Introduction

- Simulation Test for Korea National Pension Model

- Analyze of Korea National Pension Effect

- Analyze of Reducing Effect of Korea National Pension by Gini Coefficient

- Analysis of the Effect for Korea National Pension with different Coefficient Model

- Analysis of the Finance Stability for Korea National Pension with different Coefficient Model

- Result

Date: 2023.02.20 ~ 2023.04.03

Writer: 9tailwolf

Caution:

- Every codes and images are made by

9tailwolf. For personal use only. - Every datas are made by Matplotlib in Python.

- This simulation will not be precised. You should pay attention to amount of change.

Summary

- The Korean-style national pension is suitable for Korea and It has the effect of maintaining a certain level of the Gini coefficient.

- The national pension reduces the gap between rich and poor. It is particularly sensitive to the income replacement rate. And there is a linearly effect change.

- The financial stability of the national pension is linear with respect to the income replacement rate and insurance rate.

Introduction

After neoliberalism-capitalism, The gap between rich and poor problem is rising as important problem in Modern Society. Many Huge Countries have a problem with this including Korea. Since the gap between rich and poor problem cause bad for grouth1, It need to be solved.

National Pension is policy that mananging the aging asset by government. It has more adventage rather then non-national Pension2.

- It is one of the social security system.

- It managed the largest fund.

- Members can receive more money.

- It is affected to

reducing the gap between rich and poor.

In this page, I will analize National Pension by focusing on the effect of it’s reducing the gap between rich and poor. To estimate the gap between rich and poor, i will use Gini coefficient3. And recently, the issue of depletion of the national pension is also a hot topic. I will deal with that problem a little bit.

Simulation Test for Korea National Pension Model

In simulation, I made Earn-Spend-Pension model to make economic environment. To make inequality situation, I set below situation for model.

-

Earn Model is consist of polynomial function $y = bx^{a}, (a \geq 1)$ with [0,1] domain. $x$ is percent of income class. $y$ is cumulative sum of the assets. By this way, I can set inequality environment and I can make Lorenz Curve3 to calculate

Gini coefficient. Gini coefficient is indicator that evaluate inequality, 1 is the worst state(most inequality) and 0 is best state(equality). -

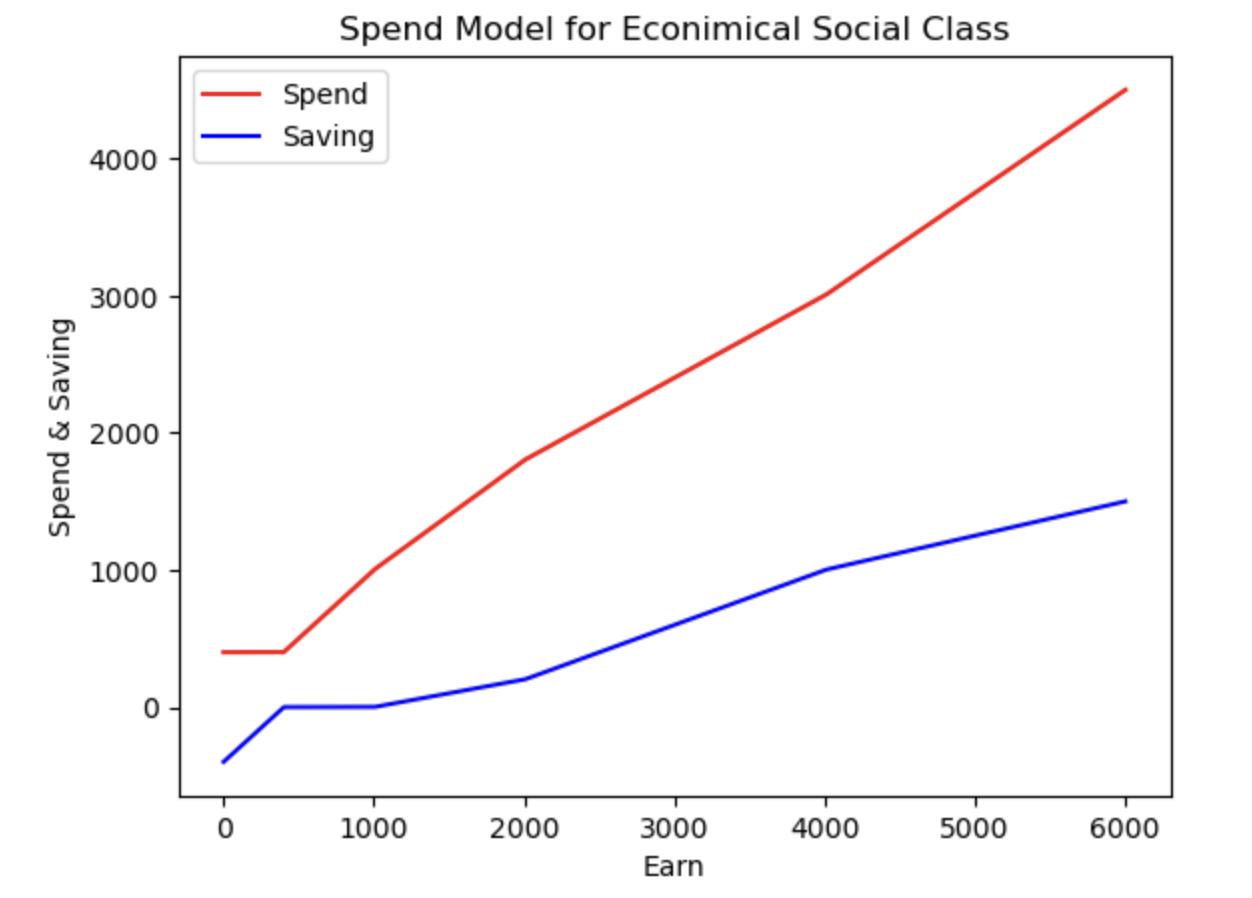

Spend Model shows the amount of money used. Since there is a minimum cost of living, I made progressive model. Below is a description for understanding my model.

- case : $\text{income} < 400 \rightarrow 400$

- case : $\text{income} < 1000 \rightarrow \text{income}$

- case : $\text{income} < 2000 \rightarrow 1000 + (\text{income}-800) \times 0.8$

- case : $\text{income} < 4000 \rightarrow 1800 + (\text{income}-2000) \times 0.6$

- case : $\text{income} > 4000 \rightarrow \text{income} \times 0.75$

- Pension Model is derived from the real National Pension of the Republic of Korea. The payment amount was set as a variable of 0.09 and can be changed later. The amount received is as follows4.

Other conditions are as follows.

- Population is 10,000.

- No change in population

- average income is 30 million won.

The initial application of the model is below.

Analyze of Korea National Pension Effect

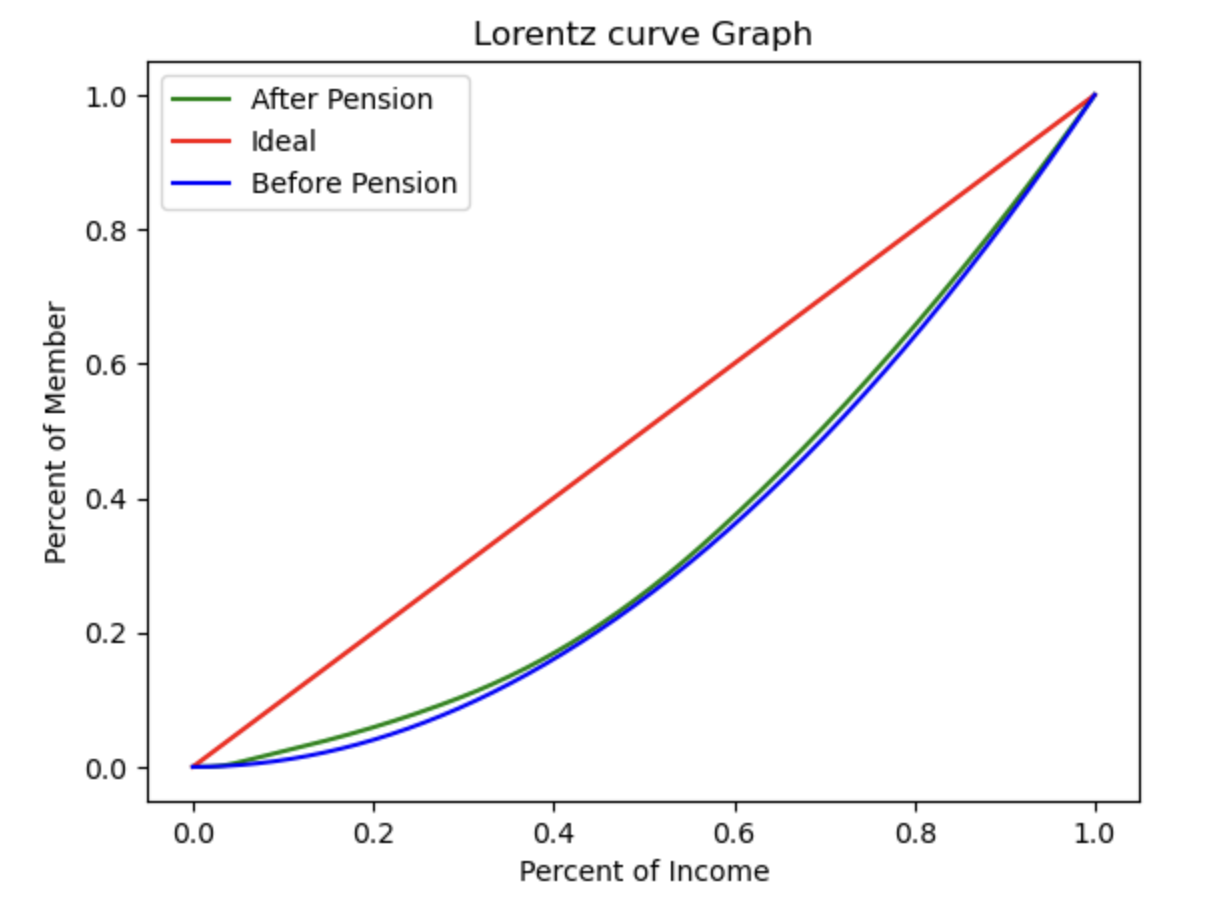

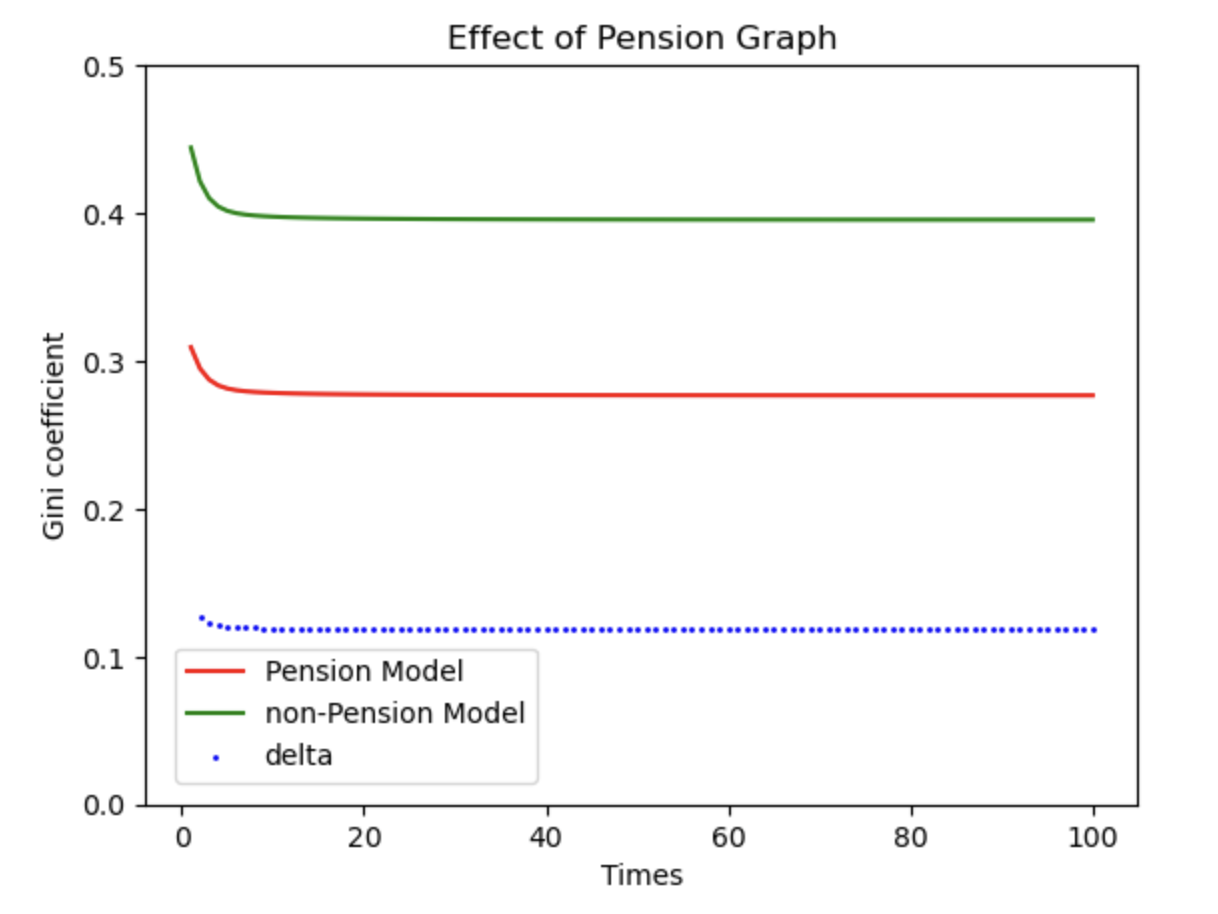

At first, I analyzed the effect of Korea National Pension. I simulated Pension Model and non-Pension Model for 100 times(=years) in 0.331 Gini coefficient5. non-Pension Model applied 1 time disable about pension model, not continuous.

As a result, the effect definitely existed. And there was an effect of gradually reducing the Gini coefficient according to time in the Pension Model. But It should be noted that in reality, this model does not have dramatic effects like the above results because there is just one reducing the gap between rich and poor policy in this model6. It should be good to understand the pension model as contributing to the maintenance of the Gini coefficient.

Analyze of Reducing Effect of Korea National Pension by Gini Coefficient

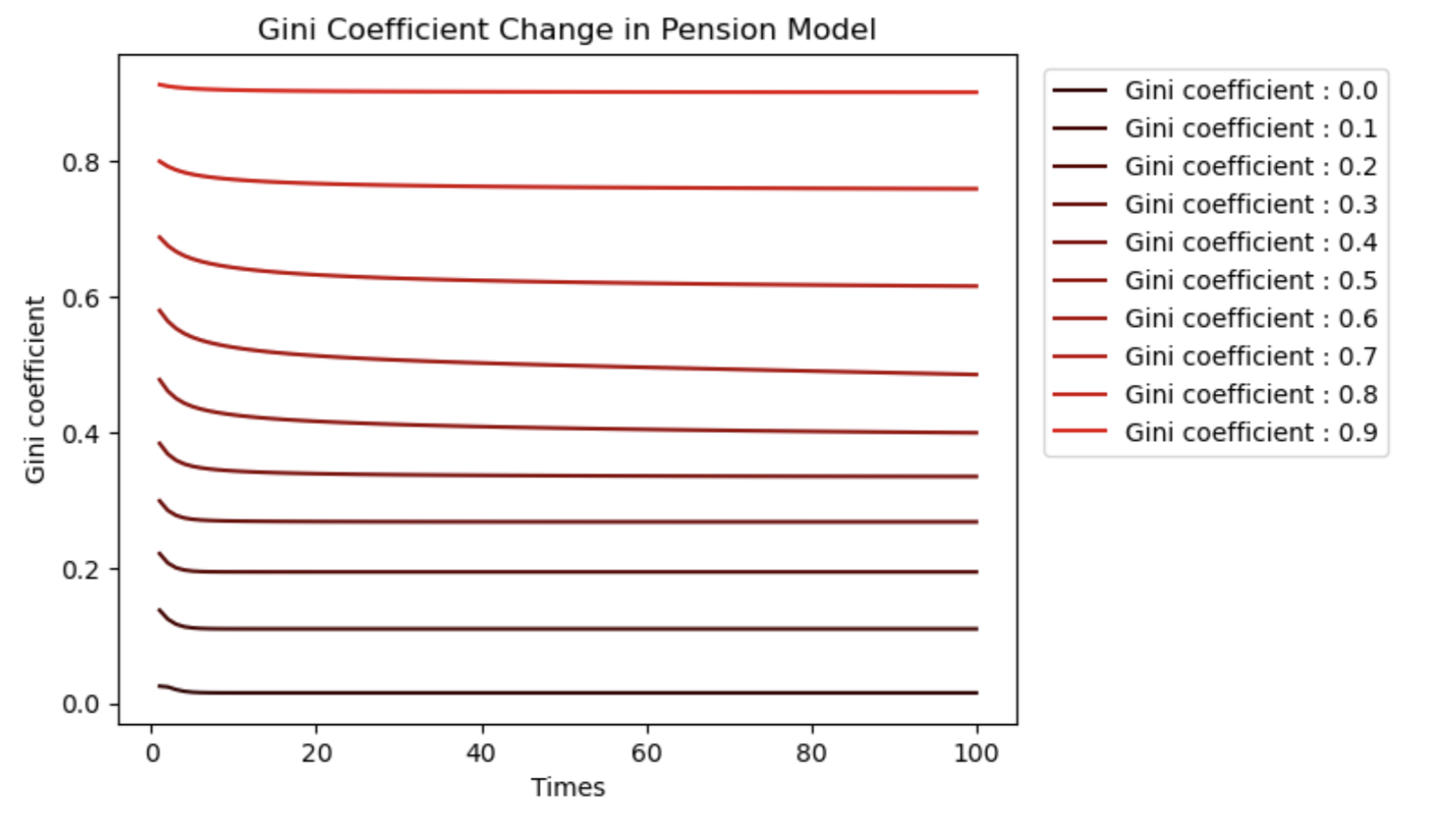

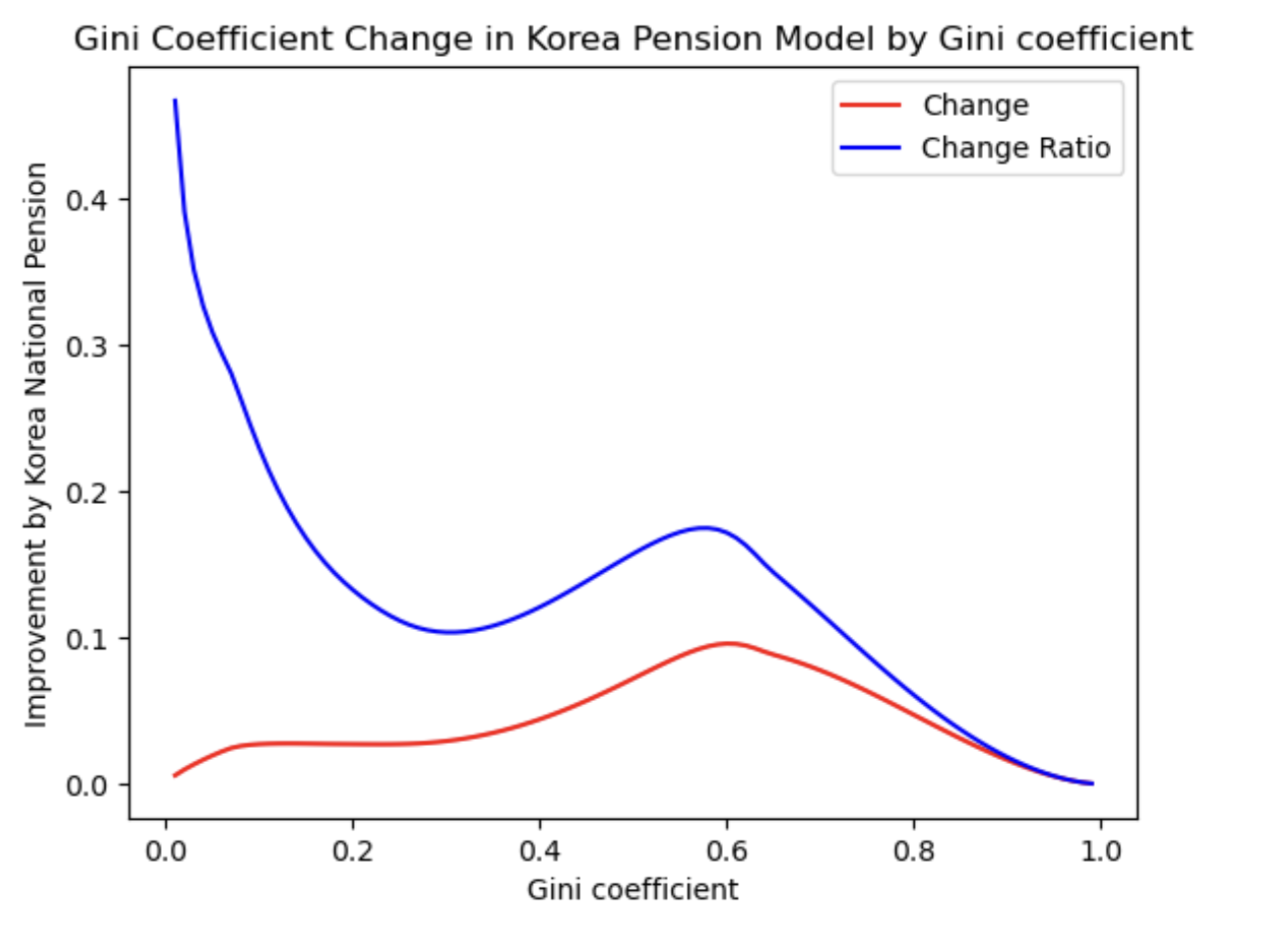

And I wonder how Korea National Pension affect. In above simulation, I learned that Korea National Pension has effect to the maintenance of the Gini coefficient, but I don’t have any idea about gap with inital Gini coefficient state. According to simulation, there is a difference in effect change tendency with inital Gini coefficient. So I simulated 100 models by different Gini coefficient(0.01 to 1.00). Below is some results.

Every National Pension model seems to have a maintenance of the Gini coefficient property. But there is no tendency according to inital Gini coefficient. Below is the result of the change of Gini coefficient of the national pension according to the initial Gini coefficient.

The results can be divided into four intervals.

- Range 0 to 0.3 : Effect is almost insignificant. However, since it is already close to the ideal, I don’t think it will matter much. It is thought that the reason why the change ratio increases when the initial Gini coefficient is very low is simply because the denominator is small.

- Range 0.3 to 0.6 : Effect is significant. Gini coefficient is improved(= reduced) and the effect ratio is increase too. I think range 0.3 to 0.6 is the most suitable range for Korea National Pension.

- Range 0.6 to 0.8 : Effect is exist but it is gradually decreases. It’s not impossible to apply, so it’s not bad to use if we don’t have the best solution.

- Range 0.8 to 1 : The gap between rich and poor is too large to resolve. Almost there is no effect.

Analysis of the Effect for Korea National Pension with different Coefficient Model

There is a two variables to determine amount pay or recieved of Korea National Pension. There is a income replacement rate7 and Insurance Rate. I analyzed the effect according to above two variables.

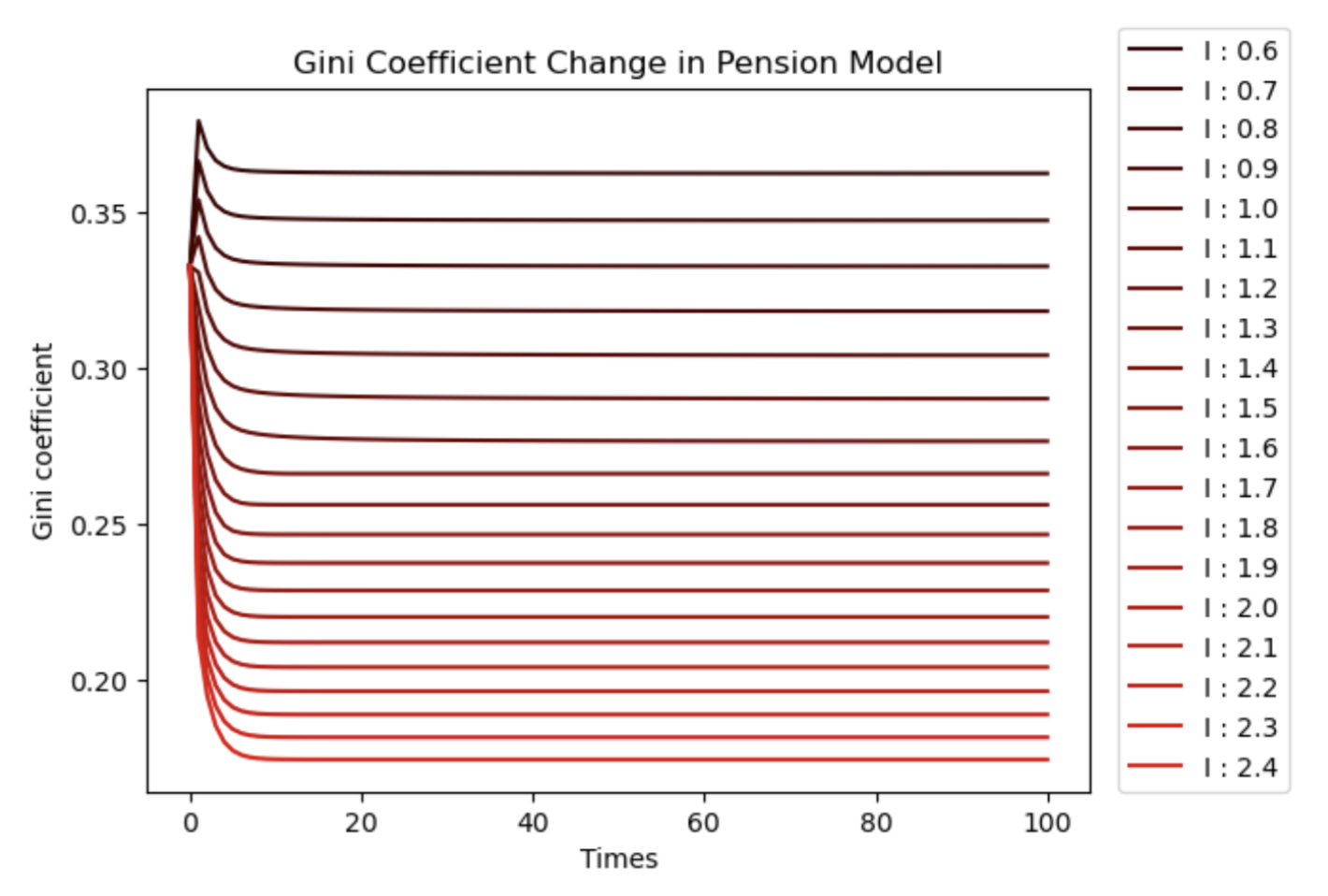

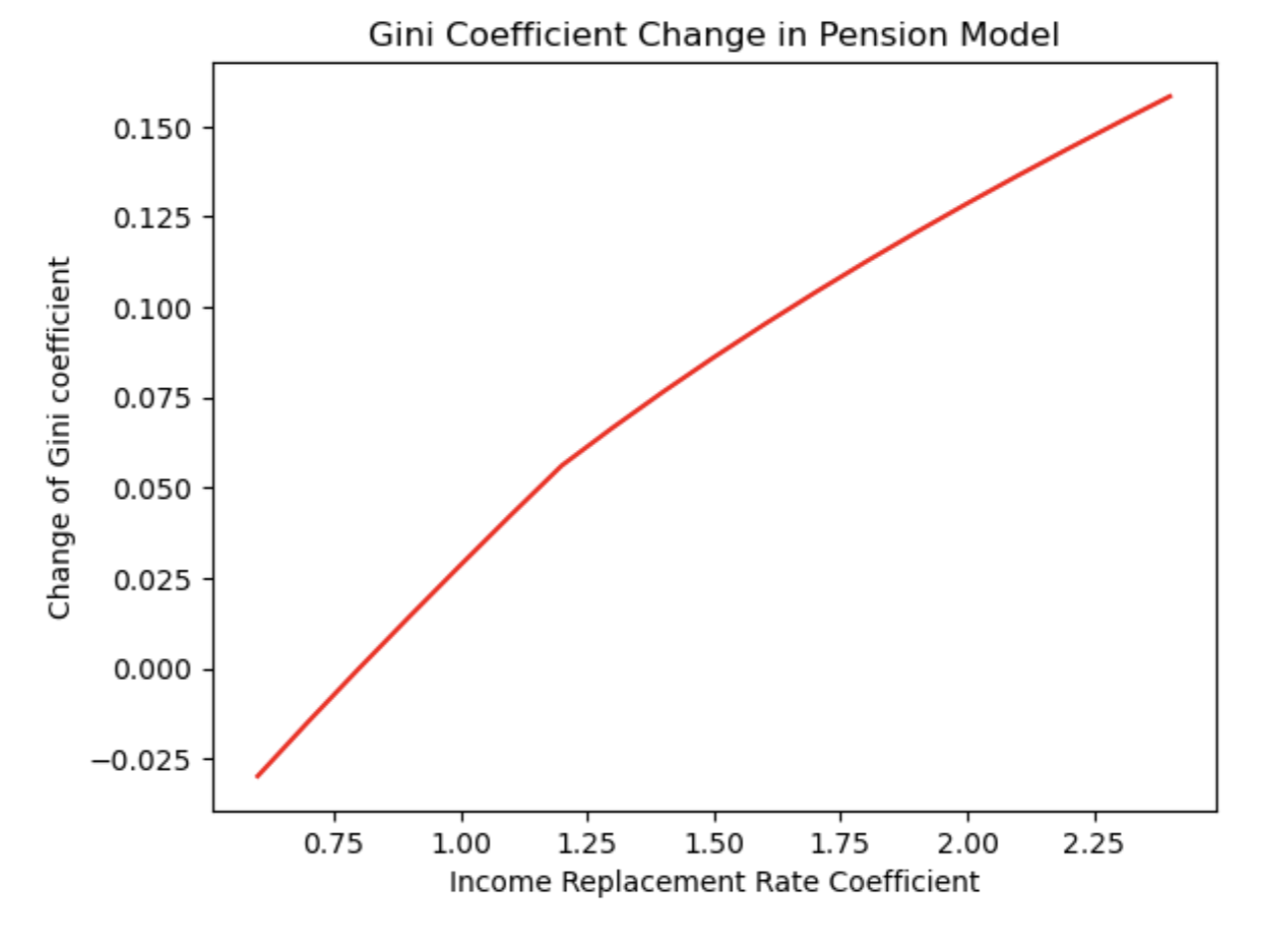

Income replacement rate determine how much money will get. When Income replacement rate increase, money will be paid more, So the effect of National Pension will be increased. Below is the simulation result of Gini Coefficient Change according to income replacement rate.

The simulation result was interesting. Models with an income replacement rate of less than 0.8 tended to maintain the Gini coefficient at a higher value than the initial value and models with an income replacement rate of larger than 0.8 tended to maintain the Gini coefficient at a lower value than the inital value. In addition, there was an income distribution effect in an almost directly proportional. And when I simply calculate linearlyhe, improvement effect is $9.90222 \times 10^{-3} $ per $0.01$ insurance rate.

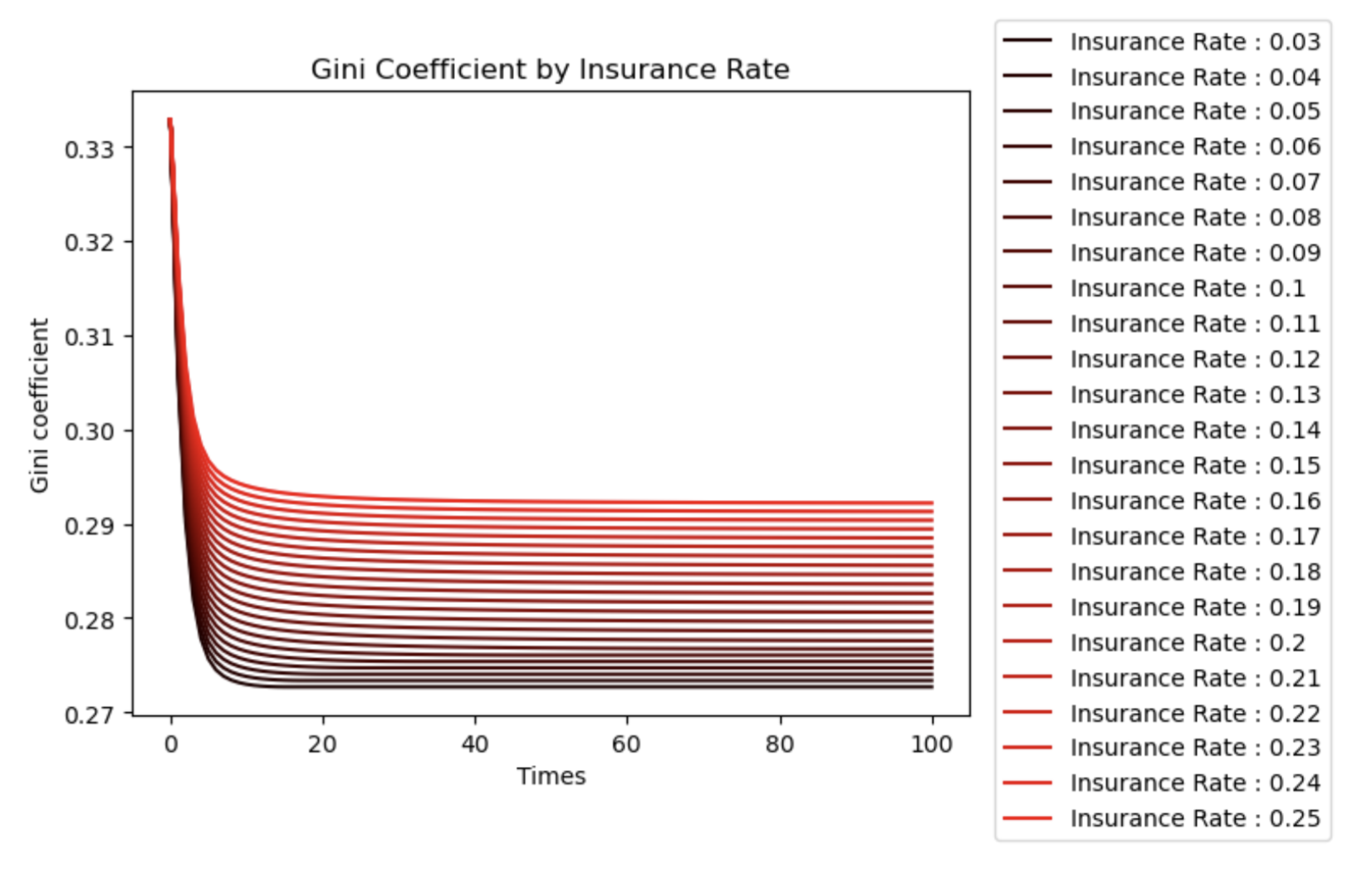

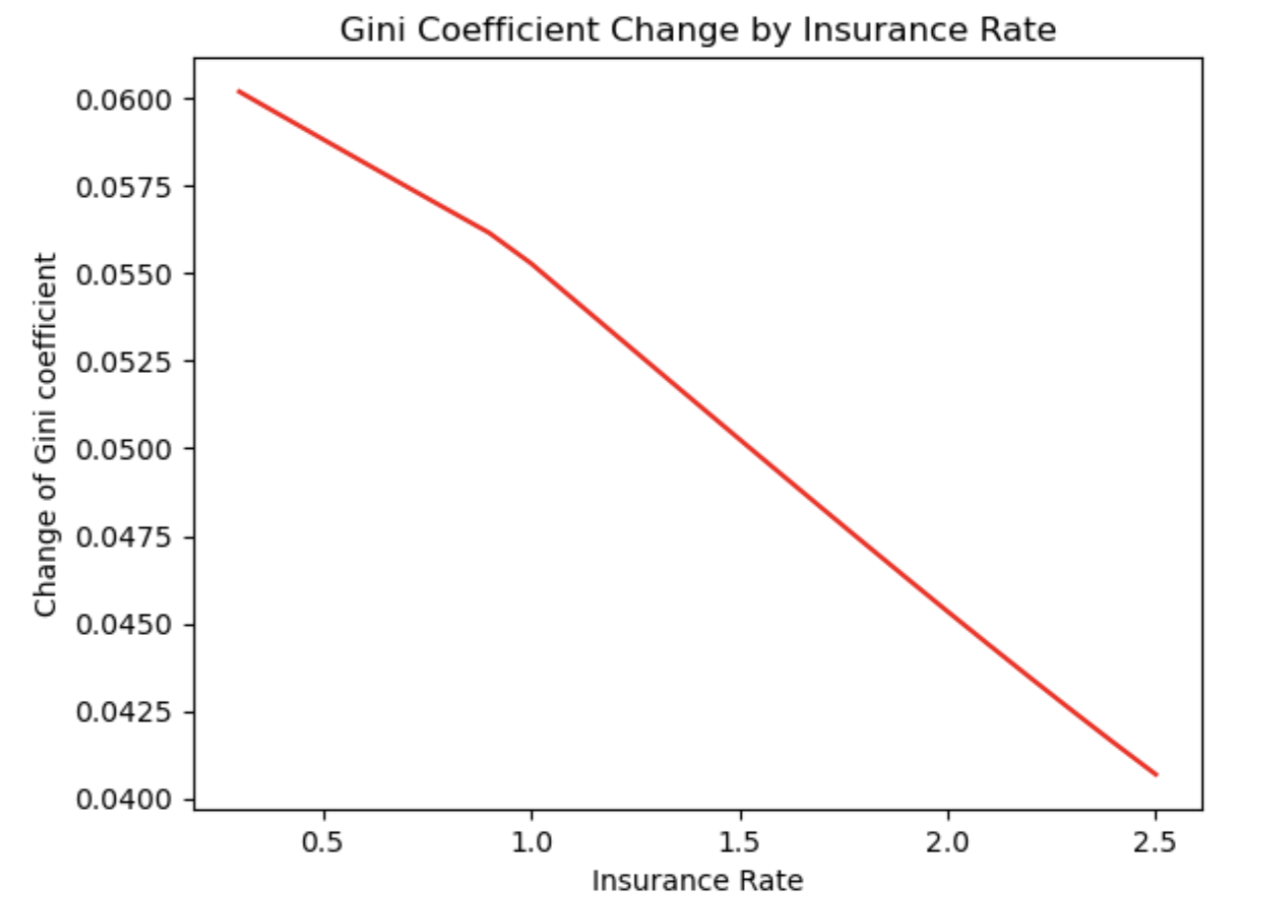

Insurance Rate determine how much money will pay. When Insurance rate increase, member of Pension will pay more, So the effect of National Pension will be increased. Below is the simulation result of Gini Coefficient Change according to Insurance Rate.

Models affect in all cases. There is some effect according to insurance rate, but the effect wasn’t dramatic. When I simply calculate linearlyhe, improvement effect is $8.48491 \times 10^{-4} $ per $0.01$ insurance rate.

As a result, in order to effectively reduce the gap between rich and poor in the Korea National Pension model, it is effective to increase the income replacement rate.

Analysis of the Finance Stability for Korea National Pension with different Coefficient Model

Today, the issue of financial stability of the national pension is emerging as the most important issue. This page focuses on the effect of reducing the gap between the rich and the poor, but since the financial stability is a hot topic, I analyzed it by simulation.

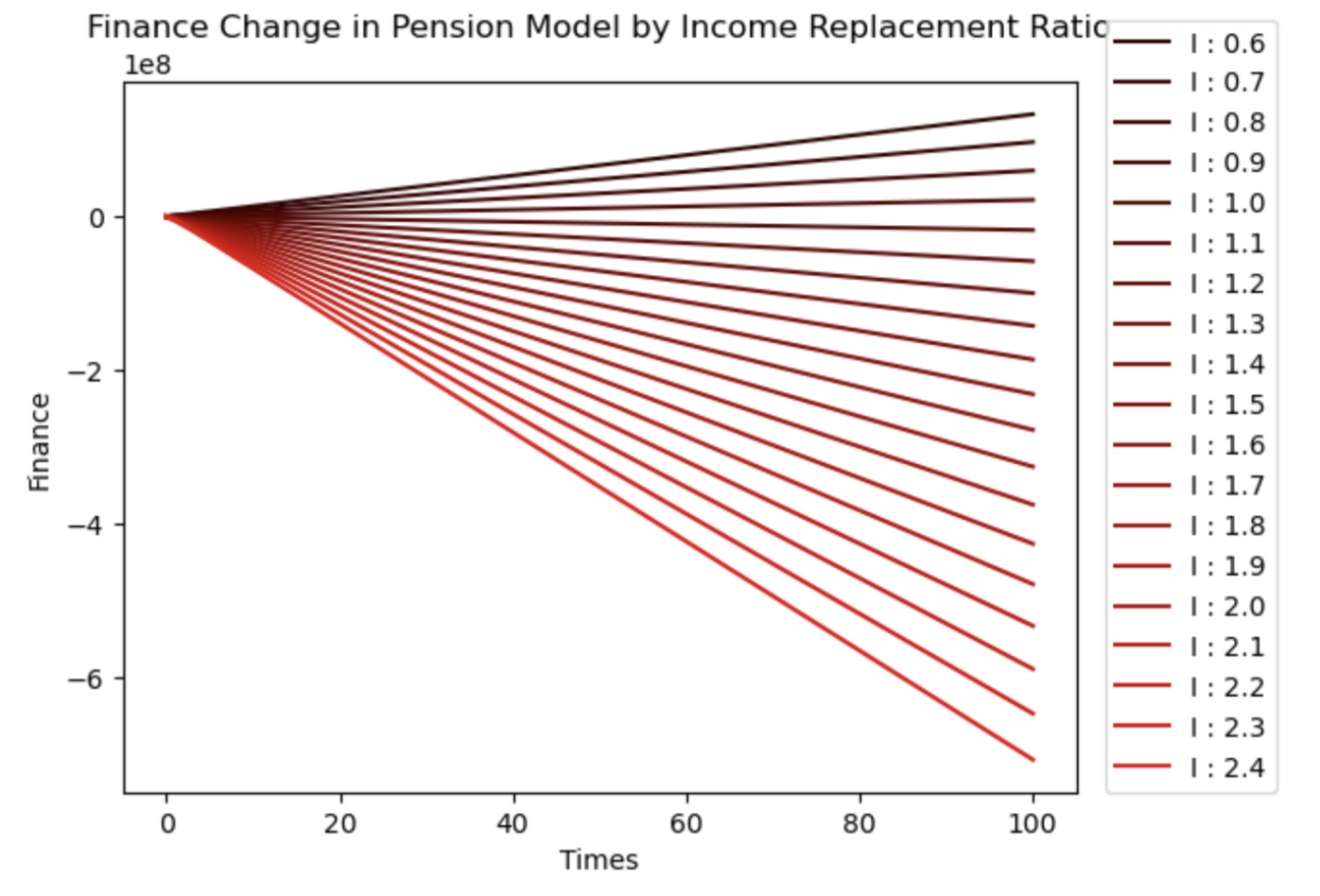

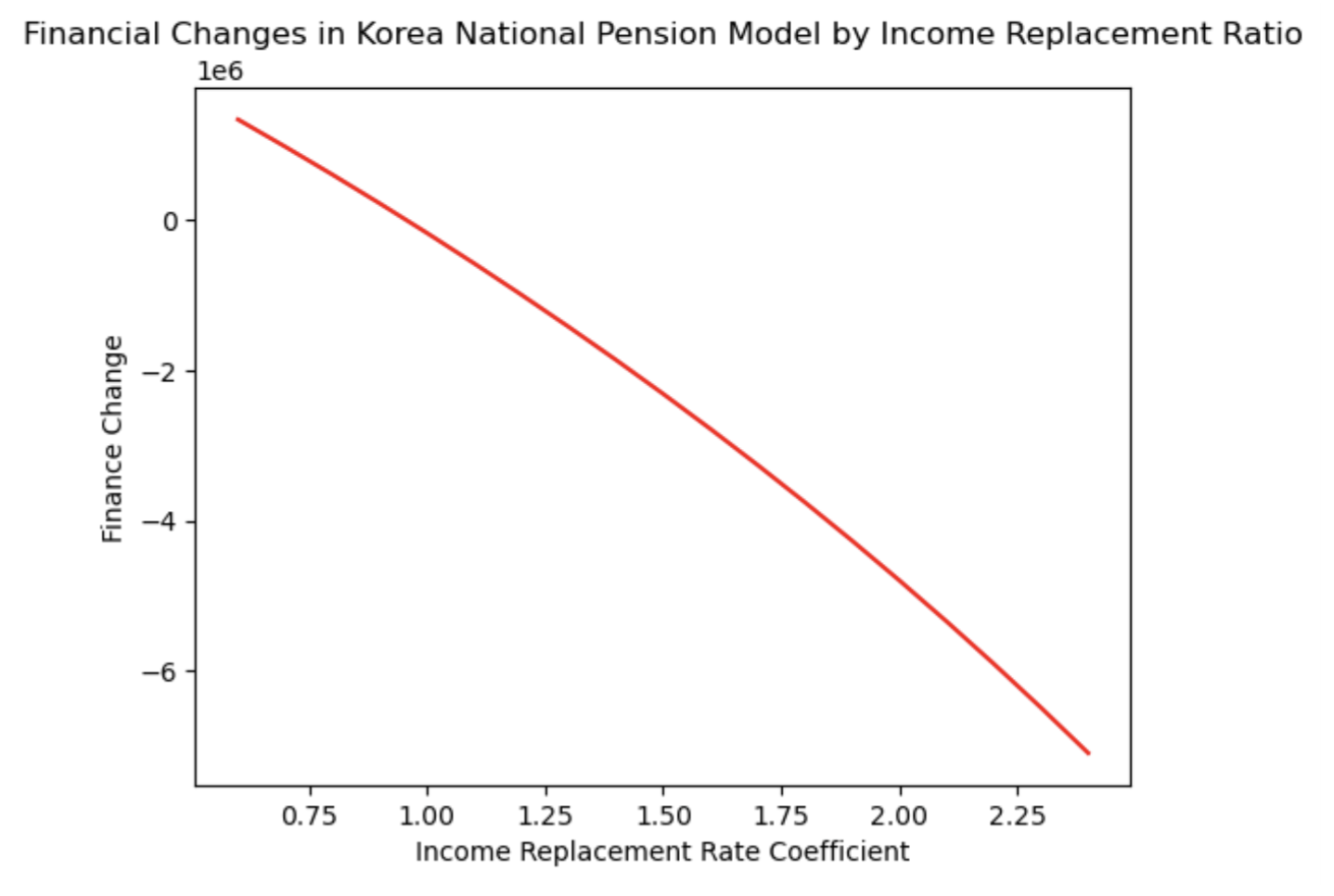

I simply identified financial stability through the same model using the above two variables, First is finacial stability according to income replacement ratio. Insurance rate is 0.09 in this model.

A deficit occurred in the sector where the replacement rate was greater than 1. In addition, financial stability showed a linear shape that was almost directly proportional.

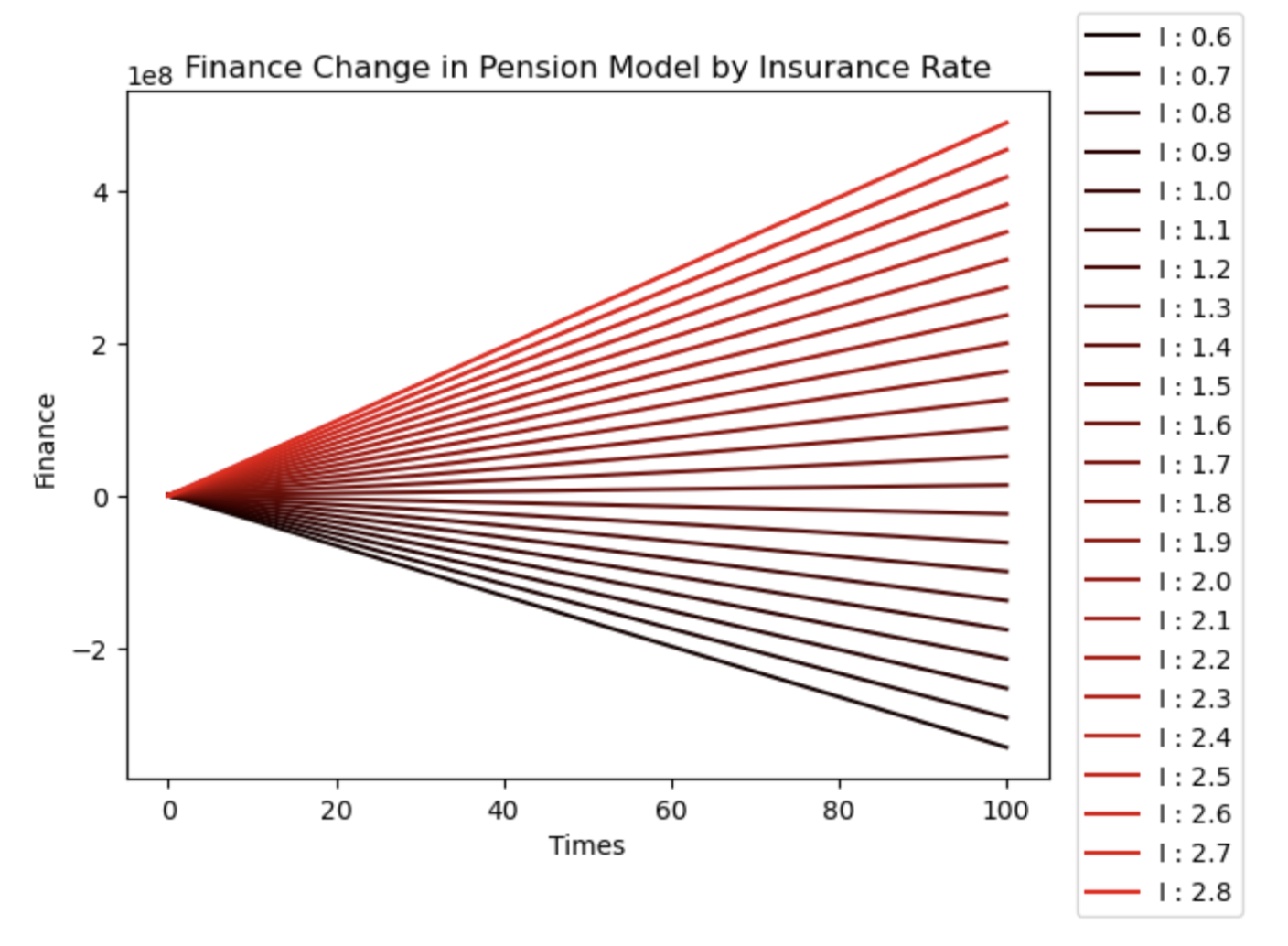

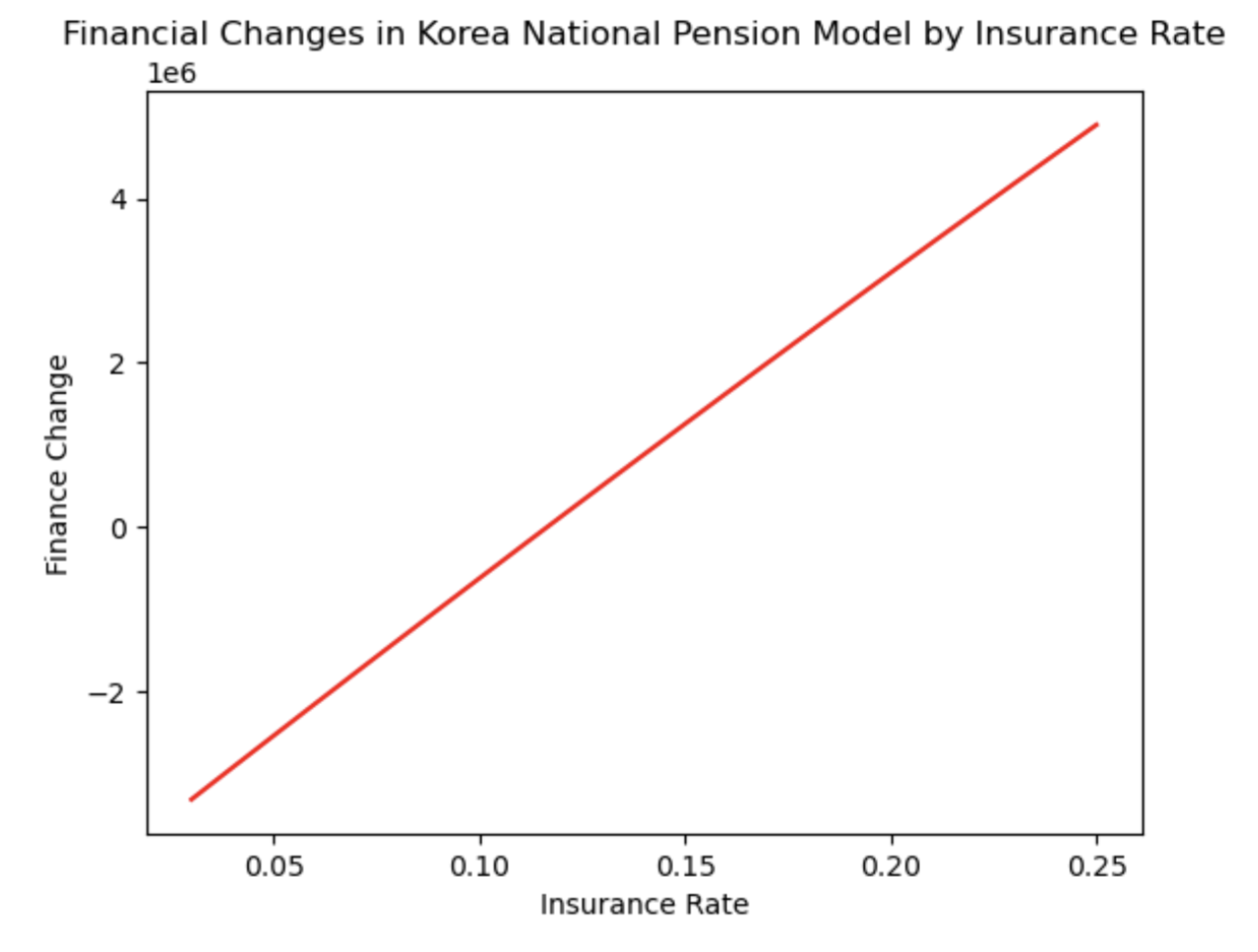

And next is finacial stability according to insurance rate. Income replacement rate is 1.2 in this model.

A deficit occurred in the sector where the replacement rate was less than 0.12. In addition, financial stability showed a linear shape that was almost directly proportional. And It can be seen that the increase in insurance rate did not greatly contribute to reducing the gap between rich and poor, but contributed to increasing the financial stability.

But there are numerous problems with this analysis. following is the three biggest problems.

First, lack of birth rate. second, lack of fund management. third, impossibility of realizing a perfect Korea environment. For this reason, precise measurements are not possible.

Since this analysis is not accurate. I just want to confirms a trend simply, it would be better to accept that financial stability changes was linear for the income replacement ratio and insurance rate.. There are many detailed studies on the finances of the Korea National Pension. It would be good to refer that.

Result

The following is a result of effect of Korea National Pension.

- The Korean National Pension model focuses on

maintanceof the Gini coefficient. Theeffect certainly exists. - The Korean national pension model showed the most effective performance at the Gini coefficient of

0.3 to 0.6. It is suitable for Korean model. - The effect of reducing the gap between rich and poor in Korea National Pension was sensitive to changes in the

income replacement rate. - The effect of reducing the gap between rich and poor was

linearfor the income replacement rate and insurance rate. - Financial stability changes was

linearfor the income replacement ratio and insurance rate.

Negative opinions about the national pension are gradually increasing. However, the Korea National Pension, which has a redistribution effect, will definitely contribute to national development. By this reason, It is necessary policy to make better nation. In order to accomplishe redistribition and Stability for National Pension, reforms must be made. I hope that the financial stability problem will be resolved as soon as possible.

Followings are future plan. My Income model didn’t reflect real Gini coeffcient because of spending. I will make more accurate model. Next plan is to figuring out the correlation between income replacement rate and insurance rate. And lastly, evaluating the former pension reform proposal of writer 유시민(Ryu Si-min, Minister of Health and Welfare, 2006.02.10 ~ 2007.05.25)8.

Reference

1: INCOME INEQUALITY, BrIan Keeley

2: 대한민국 국민연금공단

3: Investopia

4: 보건복지부

5: 통계청

6: Additional Info : I also think it is cause of Earn Model. In my simulation, Earn model is extremely biased. It should be improved.

7: 한경사전 Additional Info : Normaly, when imcome Replacement ratio(=I) is 1.2, then it is 40% of the life income. Similarly, when I is 1.5, than it is 50%, I is 1.8, than it is 60%, and I is 2.4, than It is 70%.

8: Income replacement rate change from 1.8(60%) to 1.2(40%), insurance rate change from 9% to 15%